By Todd R. Miller, Managing Partner.

Investors may describe what they are looking for in a new company in a variety of ways but invariably the lowest common denominators are the same:

1. strong management;

2. a substantial and growing market; and

3. unique product or service.

Strong management is key because it is highly likely that the original business model will need to be adjusted before the desired ROI is realized. Successful companies within an investor’s portfolio are typically those with management that understand that change is inevitable and evolve appropriately by making informed decisions. Making informed decisions means the company has sought and obtained sound advice.

The concepts of a substantial and growing market and offering a unique product or service are related. A start-up that has a reasonable chance of successfully entering a market and obtaining a strong market position is typically one that offers a differentiated product or service. Establishing a unique or differentiated product in the market is one of the more difficult keys particularly where money is tight for a new company. Two means of differentiating a product include marketing and intellectual property protection; both can be expensive. However, both may not be necessary. The following two polar opposites are illustrative.

The Pet Rock®

In August of 1975, Gary Dahl packaged a rock with straw and an instruction manual in a cardboard box designed to look like a pet carrying case. He sold his Pet Rock® product for $3.95 each. By December 1975, Dahl sold over $1M. He did so by savvy marketing.

Dahl created a press release that he sent out to nearly every major media outlet. In October 1975, Newsweek and dozens of newspapers picked up the story. The Pet Rock appeared on CBS Evening News and The Tonight Show! Even Neimam Marcus sold it.

Out of the $3.95 price tag, nearly all was profit. Each rock allegedly cost Dahl a penny; the straw was nearly free. The instruction manual and the box were Dahl’s biggest expenses, and those were most likely not high.

Dahl did have intellectual property protection for his product. He had copyright protection on the manual. And he had federal trademark protection for the mark Pet Rock®. While he could have applied for a design patent, he did not do so.

In short, Dahl did the minimal amount necessary to protect his idea, focused on marketing, and made significant money in a short time frame doing so.

The Memjet Printer

According to some economists, almost 75% of the value of publicly traded companies in the U.S. comes from intellectual property assets. If true, then it is understandable why the U.S. Patent and Trademark Office has now issued over 8,000,000 patents. On average, someone receives a patent grant every 3 minutes or registers a trademark every 5 minutes.

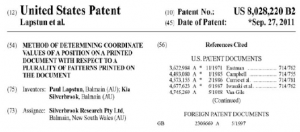

Kia Silverbrook appears to understand the import of strong intellectual property rights. He is named on more U.S. utility patents than anybody in history – over 4,600 patents, over half of which are directed to Memjet printer technology:

A Memjet printer is an ink-based printer that prints a page in a single pass resulting in higher speeds compared to ordinary printers. Memjet’s technology was developed by Silverbrook Research, a company co-founded by Kia Silverbrook.

The Memjet printer lies in stark contrast to the Pet Rock®. Without patent protection, those who wanted to sell a rock as a pet had little stopping them. Anybody desiring to use Memjet printer technology would need to license such a heavily patented product.